If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing.

Nys solar tax credit 2018.

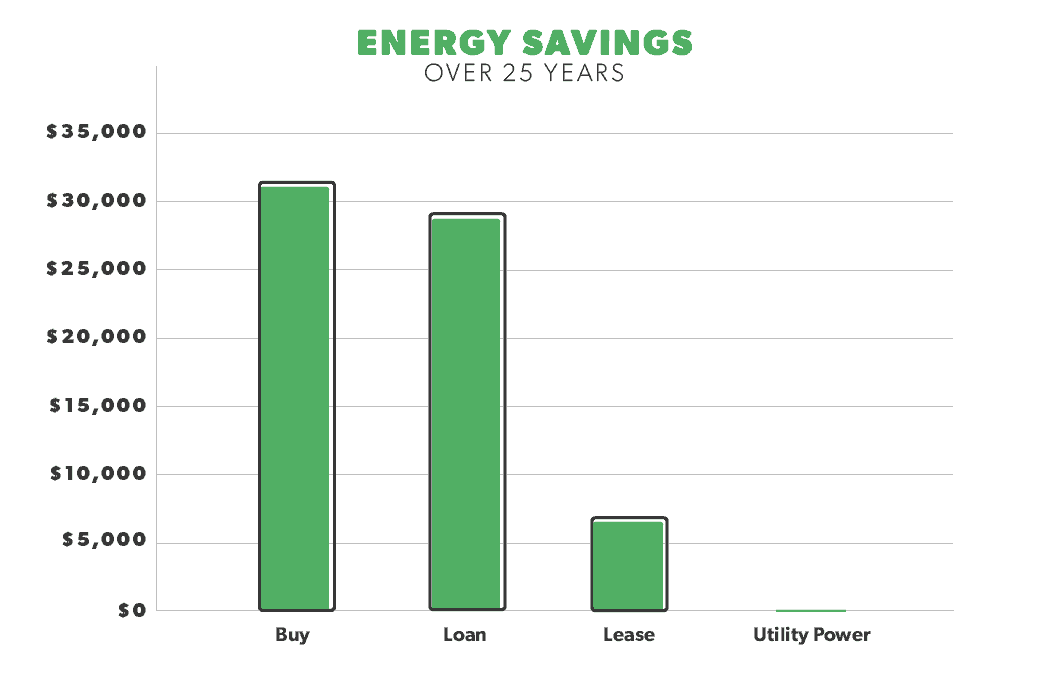

However any credit amount in excess of the tax due can be carried over for up to five years.

New york state offers several new york city income tax credits that can reduce the amount of new york city income tax you owe.

Learn how you can benefit from new york s solar incentives rebates tax credits today.

The great advantages of the solar equipment tax credit are twofold.

Are you a full or part year new york city resident.

The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

The solar energy system equipment credit is not refundable.

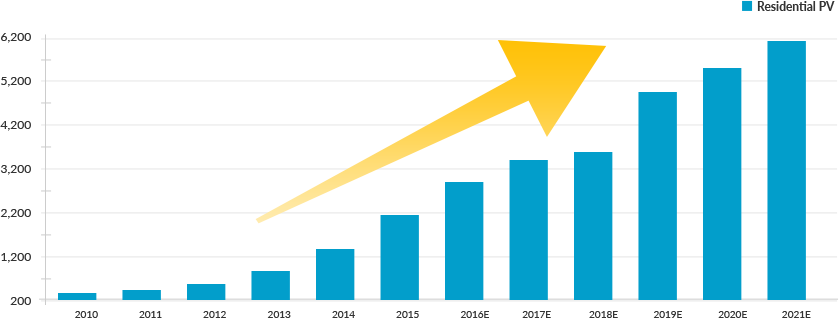

New york is a top 10 solar state 1 and for good reason.

First you don t have to purchase your system to claim the credit i e.

New york city credits.

It applies to you even if you went solar with a lease or.

In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home.